Saudi Arabia has long played a pivotal role in supporting Lebanon financially and politically. Beyond hosting a large number of Lebanese workers, the kingdom has provided significant economic assistance over the decades. This included deposits at Lebanon’s central bank, contributions to reconstruction efforts after the 2006 war, as well as expanded trade and large-scale investments in the early 2000s. But this support began to wane gradually after 2011, as Lebanon’s political stance on regional issues—particularly regarding the Syrian conflict—marked a turning point in Saudi policy toward Beirut.

As a result, Saudi investments in Lebanon declined sharply, and bilateral economic ties hit their lowest levels. The kingdom suspended tourism to Lebanon and halted imports of Lebanese goods, especially after a smuggling scandal involving contraband strained diplomatic relations between Riyadh and Beirut.

Today, however, political reforms (such as restricting weapons to the state and fully implementing the Taif Accord) and economic reforms (including restructuring the banking sector and restoring fiscal order) could remove obstacles to Saudi Arabia’s return as a diplomatic, economic, and financial partner. This renewed engagement will not be a blank check as it once was. Instead, assistance and investment are expected to be conditioned on tangible progress in reforms and the Lebanese state asserting full authority over its territory.

Forecasts suggest that Saudi reintegration into Lebanon’s economy would come swiftly after the implementation of the weapons restriction clause. This would likely be part of a broader strategy to re-anchor Lebanon within the Arab fold and curb Iranian influence by reinforcing state authority through economic empowerment.

Targeted Sectors

Saudi investments and aid are expected to focus on:

- Banking sector: The cornerstone for any Saudi assistance, since all investments will move through it. Riyadh is likely to provide both expertise and capital to recapitalize Lebanese banks and help resolve the deposit crisis. As in the past, Saudi Arabia may bolster confidence in the Lebanese pound with a central bank deposit.

- Economic reforms: The kingdom is expected to play a leading role in supporting IMF and World Bank efforts to implement a comprehensive reform program. This includes restructuring the public sector, liberalizing markets, promoting competition, fighting corruption, and improving governance and financial transparency.

- Reconstruction: Saudi Arabia was a key contributor to rebuilding efforts after Lebanon’s wars, particularly in the aftermath of the 2006 conflict. Billions of dollars are expected to be allocated for infrastructure projects encompassing roads, bridges, power, water (including dams and artificial lakes), and sewage systems. A central priority will be the electricity sector, which has drained over $50 billion from state finances. Saudi investment would target both production and distribution. The kingdom is also expected to back the reconstruction of Beirut Port, recognizing its strategic importance as a global logistics and trade hub in the eastern Mediterranean.

- Trade and investment: Riyadh is expected to lift its trade ban on Lebanese goods, imposed after the smuggling scandal, which would directly benefit Lebanon’s agriculture and industry.

- Tourism: Before 2011, Saudi visitors were among the highest spenders in Lebanon’s tourism sector. Restoring travel by Saudi nationals could be transformative, injecting hard currency and revitalizing the industry.

- Productive sectors: Investments are expected in technology, real estate, agriculture, and tourism through both public and private Saudi funds.

Mechanisms and Scale of Support

Saudi Arabia has multiple institutional mechanisms to finance foreign projects, characterized by transparency and oversight. These include the Saudi Fund for Development (the primary tool), the Public Investment Fund, direct government-to-government aid and deposits, and public-private partnerships encouraging private sector participation.

Based on historical data, the scale of future Saudi financing is projected to be far greater than in the past. Expected allocations include:

- Central bank deposits and direct aid (between $1 billion and $2 billion).

- Economic stabilization and recovery programs ($5–10 billion).

- Profitable commercial projects via the Public Investment Fund (several billion).

- Humanitarian aid through direct government support (hundreds of millions).

The goal is clear: to help Lebanon rebuild itself and align more closely with broader Arab economic and political dynamics.

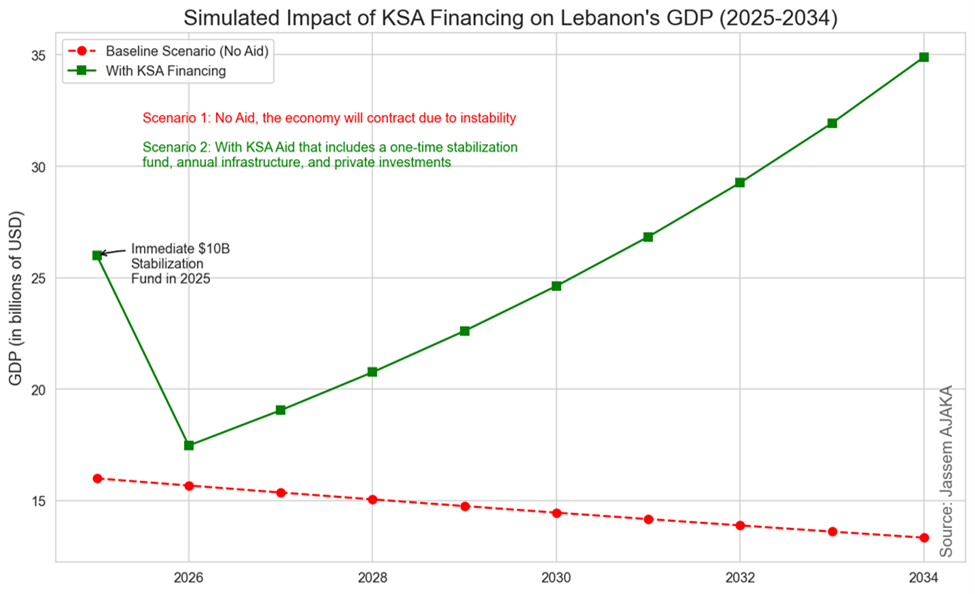

Simulations show that these Saudi investments and aid would be critical to Lebanon’s future recovery. With such support, Lebanon’s GDP could reach $35 billion by 2034—a level unattainable with Lebanon’s resources alone (see Figure 1).

Figure 1 : Simulated Impact of KSA financing on Lebanon’s GDP over the 2025-2034 period (Source: Our calculations).

Figure 1 : Simulated Impact of KSA financing on Lebanon’s GDP over the 2025-2034 period (Source: Our calculations).

Ultimately, the onus falls on the Lebanese government to implement the necessary political and economic reforms. These would mark the opening chapter of renewed foreign assistance and investment, led by Saudi Arabia.

Please post your comments on:

comment@alsafanews.com

Politics

Politics