Oil is arguably the most strategic global commodity, playing a role in the production, packaging, transportation, and consumption of over 90% of the goods and services that surround us. For this reason, oil-producing countries occupy a strategic position in global affairs, attracting international attention to their stability and security. Oil trading ranks among the largest in the world by volume and value, and global markets track crude prices closely due to their far-reaching economic and social implications.

Currently, U.S. crude (West Texas Intermediate) is trading at an average of around $63 a barrel, down from over $70 earlier this month. Price fluctuations stem from a complex interplay of geopolitical and economic factors, creating dynamics that can trigger sharp swings — sometimes severe enough to threaten global economic growth.

Geopolitics in the Oil Market

It is widely recognized that geopolitics is the primary driver of short-term volatility in oil prices. Key geopolitical factors currently influencing the market include:

- The Russia–Ukraine War – The large-scale conflict that erupted in 2022 caused sharp fluctuations in global oil markets amid fears over Russian supply. With reduced availability, countries such as India and China turned to buying discounted Russian crude despite Western embargoes and over 12,000 U.S. sanctions on Moscow. This created a parallel market that disrupted stability in official pricing.

- OPEC+ Decisions – The coalition of OPEC members and Russia wields significant influence over oil prices by adjusting supply. Its latest decision — to increase production by 547,000 barrels per day starting in September — aims to offset market losses from recent U.S. measures against Russian oil sales (notably high tariffs on India) and to stabilize prices.

- Middle East Tensions – Regional instability has influenced oil markets for decades, dating back to King Faisal bin Abdulaziz’s oil embargo following the 1973 Arab–Israeli war.

- U.S.–China Trade Frictions – As the world’s two largest economies and biggest oil consumers, any strain in U.S.–China trade relations has major repercussions for demand. Tariffs imposed by then-President Donald Trump on Chinese goods weakened global demand, contributing to price declines.

Economic Factors Shaping Oil Prices

- Global Economic Growth – A key determinant of oil prices, as higher growth fuels demand and economic slowdowns depress it. Any fears of a global recession can drag prices down, while strong growth tends to push them higher.

- Inflation and Monetary Policy – Inflation prompts central banks to raise interest rates, cooling investment, slowing growth, and consequently reducing oil demand. The dollar plays a central role here since crude is priced in U.S. currency. A stronger dollar raises oil costs for countries with weaker currencies, further dampening demand.

- Shift to Renewable Energy – While renewable energy is advancing globally, it still cannot meet total energy demand. Oil remains the dominant source, especially in transportation and industry. As renewable capacity expands, oil demand — and prices — are expected to decline in the long term.

Oil Price Outlook

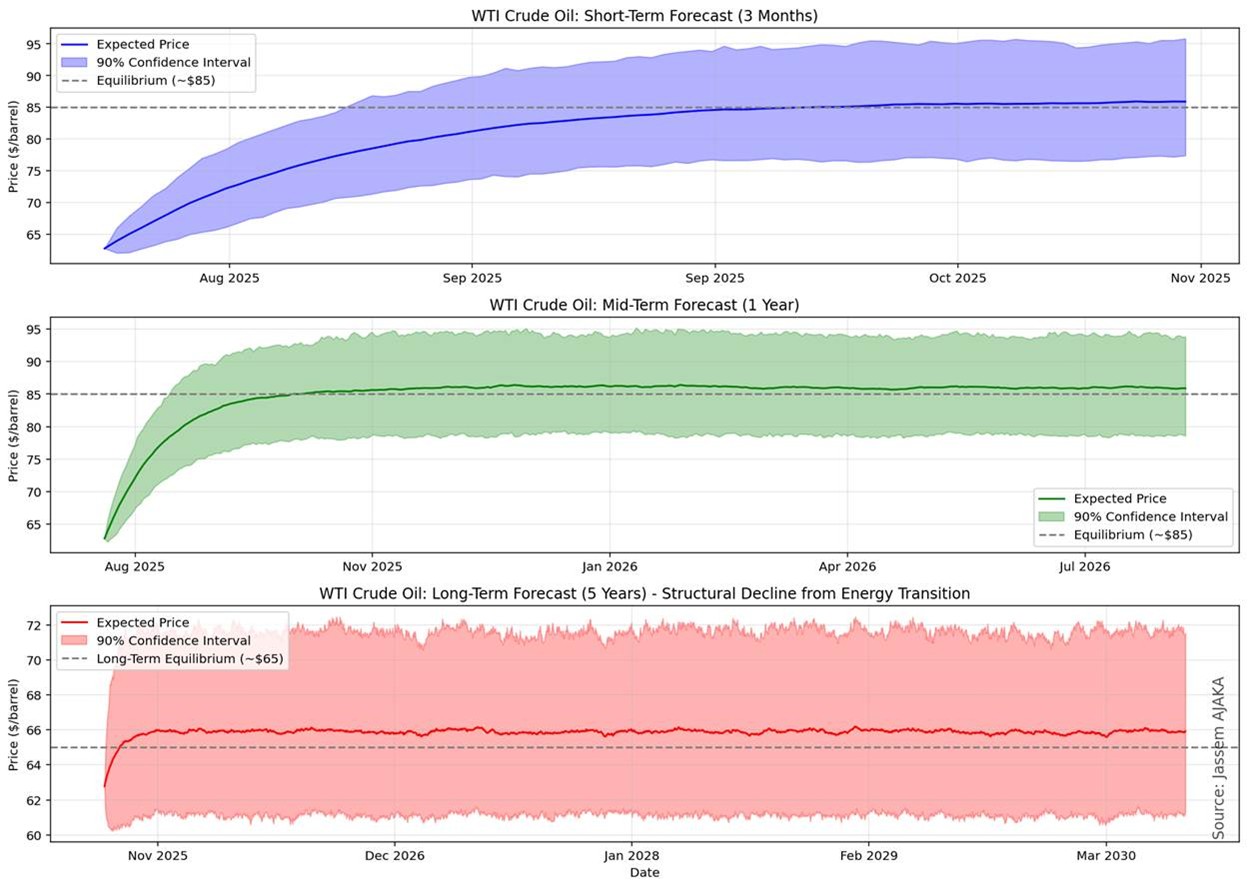

Forecasts can be divided into three timeframes:

- Short Term (3–6 months) – High volatility is expected to persist amid geopolitical tensions and economic uncertainty. Statistical simulations suggest U.S. crude prices will range between $60 and $75 per barrel.

- Medium Term (6–12 months) – Prices will hinge on OPEC+ strategy and resolution of geopolitical crises. If tensions ease, prices could drop to $55–$70 per barrel.

- Long Term – A sustained decline in prices is likely as renewable energy gains ground. In the absence of major geopolitical shocks, prices could stabilize between $50 and $60 per barrel in the coming years.

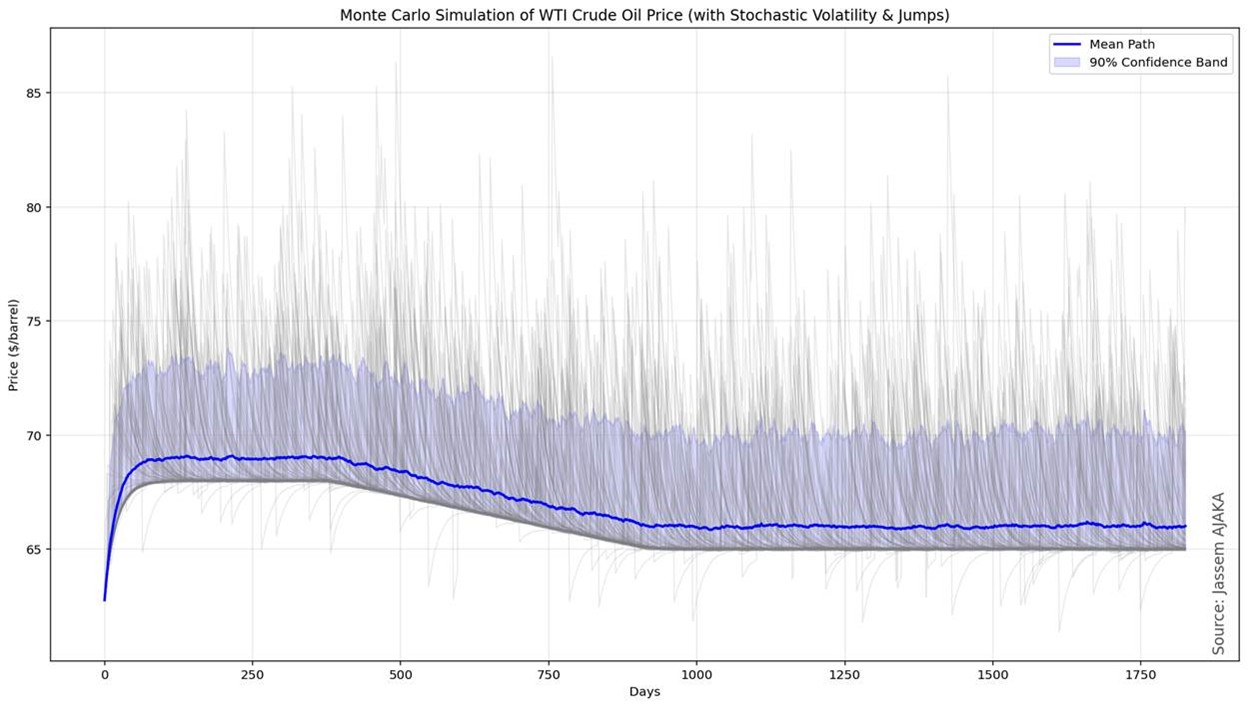

Figures 1 and 2 illustrate these forecasts. The first uses a Constant Volatility model, while the second applies a more advanced method combining Stochastic Volatility with Geopolitical Shocks — both producing consistent results.

Figure 1: WTI Crude Oil – Short, Mid, and Long Term Forecast using Constant Volatility (Source: Our Calculations)

Figure 1: WTI Crude Oil – Short, Mid, and Long Term Forecast using Constant Volatility (Source: Our Calculations)

Figure 2: WTI Crude Oil Forecast using Stochastic Volatility and Geopolitical Shocks (Source: Our Calculations)

Figure 2: WTI Crude Oil Forecast using Stochastic Volatility and Geopolitical Shocks (Source: Our Calculations)

Implications for Lebanon

As an oil importer, Lebanon faces wide-ranging repercussions from rising global prices:

- Higher Inflation – Increased oil costs push up production, packaging, and transport expenses. In Lebanon’s highly monopolized market, which imports over 80% of its needs, this directly erodes purchasing power and fuels poverty.

- Electricity Costs – Higher oil prices raise operating expenses for Électricité du Liban. This could either reduce power supply or force the government to increase subsidies, swelling the budget deficit.

- Trade Deficit – A larger import bill for fuel worsens Lebanon’s already fragile trade balance, draining foreign currency reserves.

- Remittances from the Gulf – Higher oil prices often boost remittances from Lebanese expatriates in Gulf countries, and the reverse is also true.

The Need for Reform

Mitigating the impact of oil price increases requires structural political and economic reforms — steps that Prime Minister Nawaf Salam’s government has begun to implement. With only months remaining in its term (unless parliamentary elections are delayed), the question remains: can this government push through the necessary reforms and attract foreign investment, particularly from the Gulf?

Please post your comments on:

comment@alsafanews.com

Politics

Politics