The cabinet of Prime Minister Nawaf Salam faces its most difficult test since its formation, as it prepares on Tuesday to tackle a divisive and highly controversial issue: the disarmament of “Hezbollah”. While this is not the first time the matter has been raised, external pressure—both military and economic—now compels the government to drink from this bitter cup. Notably, since the government’s formation, the President of the Republic has taken it upon himself to address this matter in order to avoid an internal collapse.

From an economic standpoint, the key question is: what are the possible outcomes of the political scenarios expected from tomorrow’s session? Here, we will not discuss the matter from a political lens, but focus solely on its economic implications.

Three main scenarios lie ahead for Tuesday’s cabinet meeting:

Scenario One: Disarmament Through Negotiation — A Cautious Path Forward

Under this scenario, the government would decide to adopt a gradual, phased approach to extend state authority across all Lebanese territory, reaffirming the principle of the state’s monopoly on the use of force. This would secure international support to build the Lebanese army’s capabilities, bolster its operational presence starting south of the Litani River and moving northward, and secure substantial international funding for reconstruction and army modernization—potentially $1 billion annually over ten years.

Such a move would unlock international aid and investments and lay the groundwork for long-term security stability. International assistance and reconstruction funding would likely flow immediately upon the announcement of a credible disarmament plan. This means billions of dollars pledged by donors—such as in the CEDRE Conference—would finally be unlocked, contingent on political and economic reforms. All of this would positively impact Lebanon’s financial, monetary, and economic situation.

Scenario Two: Symbolic Commitment — Status Quo Maintained

In this scenario, the cabinet would adopt a statement affirming the state’s exclusive right to possess arms—an approach that would be palatable to international opinion. However, such a move would likely be met with caution by donors, leaving Lebanon in a state of lingering instability. This half-measure could expose Lebanon to further crises and jeopardize its sovereignty in the long term.

Economically, this scenario represents a continuation of the status quo, with poor economic prospects reflecting ongoing stagnation and crisis. There would be no immediate influx of aid, which would remain limited. The government’s inability to fully control arms would give the international community reason to withhold its commitments. Economic hardship would persist, especially with Lebanon facing financial—and even military—containment, leading to potential social crises that could, for example, fuel increased emigration.

Scenario Three: Escalation — A Humanitarian Catastrophe

In this scenario, the situation would spiral out of control. The government’s failure to secure a monopoly over arms, as demanded by the international community, could prompt Israel to escalate its attacks on Lebanon. Matters could go further, with the United Nations Interim Force in Lebanon (UNIFIL) placed under Chapter VII of the UN Charter, Lebanon added to the Financial Action Task Force’s blacklist, and foreign aid suspended. There are also concerns that sectarian tensions—stirred by external actors—could erupt into armed conflict, possibly drawing in neighboring states. This would put Lebanon’s sovereignty at grave risk.

Economically, this is the most destructive scenario. The likelihood of sanctions and financial isolation would be extremely high. Sanctions could target politicians, even from within the government and parliament, isolating Lebanon and placing it among countries facing humanitarian disaster. The nation could lose its ability to import or export, remittances could be severely restricted, and tourism, agriculture, and industry could collapse entirely. The lira would plunge to historic lows.

Economic Indicators Under the Three Scenarios

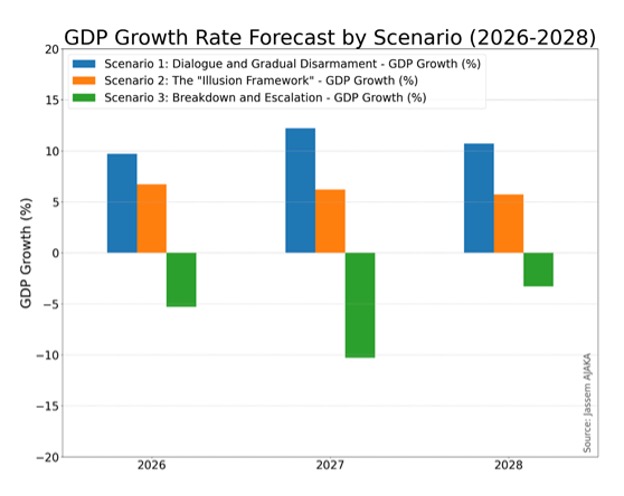

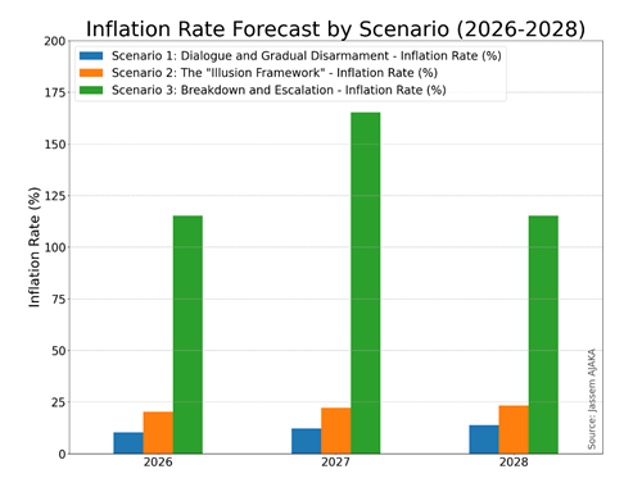

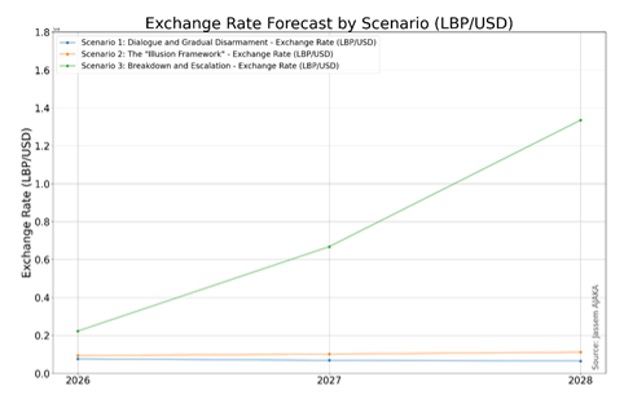

A simulation of key economic indicators under the three scenarios—though approximate, given the political complexities—clearly illustrates the direction of Lebanon’s economy in each case. The model, while simplified, factors in political stability, international aid, and domestic economic performance.

The main indicators simulated include: real GDP growth (%), inflation rate (%), and the Lebanese pound’s exchange rate against the U.S. dollar.

Results show that Scenario One would lead to economic recovery, with double-digit growth, stable inflation, and a steady exchange rate. Scenario Two would reflect the continuation of the current reality. Scenario Three would be catastrophic: negative real economic growth, hyperinflation, and an exchange rate surpassing six figures (see Charts 1, 2, and 3).

In conclusion, tomorrow’s cabinet decision will be one that touches on Lebanon’s sovereignty, security, and future. Can the government enforce state authority without causing internal division—and meet international demands without undermining national dignity? It is clear that whatever decision emerges will resonate far beyond Lebanon, echoing in the capitals of the world.

Please post your comments on:

comment@alsafanews.com

Politics

Politics